February 21st, 2009 — People, Reflexion

Pourquoi nous devons faire honneur a notre invité et de le respecter? J’étais surpris en lisant sur la rubrique du forum signe A.C. sur le Mauricien d’hier. Je respecte et comprends que tout le monde ne peut pas avoir la même opinion. Vive la diversité.

LA CHINE

Une amie qui nous veut du bien ?

Lors de la visite d’Etat de 28 heures du président chinois, Hu Jintao, le protocole rigide mis en place a fait sourciller. Ainsi, de l’arrivée du chef de l’Etat chinois, lundi, jusqu’à son départ, dans la soirée de mardi, la petite Ile Maurice qui a l’ambition d’être une économie fonctionnant 24 heures 24, 7 jours sur 7, a tourné au ralenti.

Entre-temps, routes interdites aux automobilistes et réservées uniquement au cortège présidentiel.

Pour les plus courageux des usagers de la route, un labyrinthe de déviations routières. Institutions publiques et entreprises : fermeture plus tôt que d’habitude.

Et congé forcé pour les écoles.

Qu’importe.

Le tigre de l’océan Indien n’a qu’à bien se comporter devant le dragon chinois, n’est-ce pas ?

Et pour cela, quoi de mieux que le politiquement correct.

Rien évidemment sur la situation au Tibet dans le discours du Premier ministre mauricien !

Ni sur les droits de l’homme !

Rien sur l’importance des libertés fondamentales ou de la démocratie !

Ou encore sur la liberté d’expression et de la presse ! La Chine exerce d’ailleurs un contrôle farouche sur l’information et l’internet.

Au contraire, on a eu droit à l’apologie du système communiste chinois. Ainsi notre Premier ministre a-t-il expliqué dans son discours qu’en cette période de récession économique, le modèle de la centralisation d’État est celui qui fonctionne le mieux.

Fini le capitalisme, vive le communisme chinois !

Entre-temps, la partie chinoise s’efforce, par tous les moyens, à faire taire la voix de ses détracteurs.

C’est ainsi que l’éditorial du Mauricien de lundi dernier nous apprend que la rédaction de ce journal a été sollicitée pour qu’une lettre ouverte d’Amnesty International ne soit pas publiée dans ses colonnes.

Lettre qui a été publiée en page 6 du même journal. ” La rédaction du Mauricien aurait certes préféré que la diplomatie chinoise à Maurice se dispense, […] de nous faire savoir qu’elle a appris que nous comptions publier une lettre ouverte d’Amnesty International et qu’elle apprécierait que nous ne le fassions pas “, regrette l’éditorialiste.

Les pratiques féodales des dirigeants chinois, la courtisanerie et courbettes des dirigeants africains, dont les nôtres, devraient nous amener à nous demander si nos relations avec la Chine sont vraiment fondées sur l’amitié.

L’Afrique et la Chine : sommes-nous voués à être de faux amis ?

AC

Si nous recevons un ami chez nous sur notre invitation, est ce pour lui faire la leçon ? Qui détermine la façon la façon de diriger son pays, démocratie ou communiste ?

Devons nous dire au grand public, les externes à notre amitié, qu’il faille traiter mieux tes enfants chez toi ? Que tes enfants que tu considères et traites de renégats soit traité mieux ?

Quand je reçois chez moi, je fais tout pour plaire à mon invité. Je me casse en deux. Je me sacrifie pour te rendre heureux. J’arrange mes meubles afin d’éviter que ton passage chez moi soit avec aisance et surtout tu gardes un bon souvenir de ta visite. Je partage avec toi ma meilleur cuisine, je demande aux enfants de ne pas incommoder notre rencontre, t’introduit mes meilleurs amis et surtout je m’assure que les personnes qui te sont hostiles sont absents de ta vue.

Enfin de compte, pourquoi ile Maurice, par son premier ministre, Ramgoolam a invité Président HU Jintao ? Et Pourquoi La Chine a accepté l’invitation ? Quel est l’intérêt commun ou quels sont les intérêts de uns et les autres ? What’s in for me?

February 20th, 2009 — Entrepreneurship, learning, Reflexion

I have been reading a number of articles on the present world financial crisis and the looming recession the countries are going through.

How deep into the recession shall we have to go before we are back to growth? How long will it last? What should be done during this period to experience minimum damage? What should be the behaviour of an enterprise or and individual during the recession?

Since the expansion is not prevailing, there is little use in trying to expand your market. Would it be proper to take the time to review your internal operation in seeking savings and improvement of your efficiency? Innovate and seek better ways of performing. More output with less input.

In every threat there is an opportunity. In time of recession, cash is King. The shake of the economy may probably bring down the fragile enterprises. There might be opportunities in taking over enterprises with future potential which have not resisted the wake.

I have extracted from the Quarter review of Mc Kinsey, the interesting and relevant article to the crisis:

What does the future hold?

Despite the shared features of the past century’s financial crises—usually, excess leverage somewhere in the financial system and then a breakdown in confidence—the recessions following them were quite different. What determined the length and severity of those recessions was how governments responded: in particular, whether they managed to restore confidence among consumers, companies, investors, and lenders.

An economic crisis becomes a catastrophic recession only if it blocks the provision of capital to businesses long enough to generate widespread corporate failures. This blockage is what made the Asian financial crisis so devastating. Net capital inflows to the region, $93 billion in 1996, turned into net outflows of $12 billion in 1997. Local banking systems just couldn’t provide the capital to plug this gap, foreign banks weren’t prepared to extend credit, and the International Monetary Fund (IMF) moved too slowly. As a result, businesses couldn’t finance working capital, let alone investment, and failed to obtain the export financing these countries needed given the high share of exports in their GDPs. Once the flow of credit had been restored, the economies affected by the crisis recovered quickly.

Similar dynamics were at work during the Great Depression, when a combination of bank runs and limited federal controls undermined the financial economy. From 1929 to 1933, almost half of the banks operating in the United States before 1929 either failed or needed government assistance, as a result of falling prices, the doubling of the country’s debt-service ratio, and the default of more than half of US farm debt.12 Many of the companies with the strongest credit couldn’t obtain long-term debt capital in the years after the crisis. Moreover, capital had minimal cross-border mobility in the 1930s. With businesses starved of funding, corporate investment fell by more than 75 percent from 1929 to 1933, according to Bureau of Economic Analysis data.

Under less extreme conditions, with the right kind of government intervention, economies can weather even sizable credit crises. From 1981 to 1983, for example, Federal Deposit Insurance Corporation (FDIC) data show that 258 US banks failed or required assistance. Nonetheless, nonresidential US investment fell by less than 1 percent in all. During the entire 1980s, almost 750 banks failed and more than 1,500 required assistance, as opposed to 35 during the preceding decade. Yet corporate investment increased by an average of 4.5 percent a year in the ’80s.

Today, the real economy goes into the recession surprisingly well prepared: US industrial companies had lower leverage and higher interest coverage than they did going into the dot-com bust, the S&L crisis, or even the oil shocks of the 1970s. How the real economy fares will depend greatly on the way the current policy debate plays out over the next few quarters.

What should companies do?

We do not yet know how the current crisis will evolve. The confidence of consumers, corporations, and investors—a key factor—cannot be forecast. Nor can government policy. Yet research shows that in past recessions, companies pursuing a purely defensive strategy fared less well than their more active counterparts.13 As the economy enters what will probably be a difficult downturn, companies should prepare to seize their opportunities.

Examine the patterns

Although recessions differ, it’s worth understanding how different industries performed during past downturns and what factors determined the speed of recovery. In coming months, as the focus of government policy shifts from fire fighting to economic stimulus, this kind of research will help companies understand the implications for themselves and assess how the evolving macroenvironment will affect them in the next few years.

Overprepare

Most companies already have contingency plans, but few plan as aggressively as they should. It’s worth preparing for the worst—for example, major customers filing for bankruptcy, capital expenditures needing to be cut in half quickly, or a country sales operation losing access to local-currency working capital. What seems improbable now could become a reality sooner than you expect.

Scan for opportunities

Managing downside risk shouldn’t blind executives to potential upsides. Despite the current turbulence, in most industries it isn’t hard to identify either the companies that will find themselves under pressure or which consolidation and reshaping scenarios might emerge. Instead of reacting to situations on short notice as they arise, invest time now to understand how such forces might affect your industry and what role you want your company to play.

About the Authors

David Cogman is an associate principal in McKinsey’s Shanghai office, and Richard Dobbs is a director in the Seoul office.

February 18th, 2009 — books

In his book the guru of marketing Martin Lindstrom discusses the mechanism of buying.

Buyology unveils the results of marketing guru Martin Lindstrom’s pioneering threeâ€year, $7 million dollar study that used the latest in brain scan technology to peer into the minds of over 2,000 people from around the world. The shocking results will overturn reveal why so much of what we thought we knew about why we buy is wrong, rewriting the rules of marketing and advertising in the process.

I am very keen to read the guru’s research on the subject. My marketing back ground and the life path career which has always been related to buy and selling excites me to learn more on the book. Luckily, a summary of the book is available on the net.

Pyscho marketing and now: Neuro marketing! Wow I like it.

CHAPTER 1: A rush of blood to the head

Many of our buying decisions take place so deep within our subconscious minds, that we’re not aware of what is driving them. By using the most sophisticated brain scanning techniques available, a team of scientists from across the world spent close to four years scanning consumers’ brains. Neuromarketing is a powerful new research methodology, and it promises to challenge the tenets of traditional market research. Whether it’s a pack of cigarettes, a new car, or a can of soda, the Project Buyology research findings shed fascinating new light on why we buy the things we do. The $7 million project questioned everything we thought we knew about why we buy. ‘A rush of blood to the head’ takes the reader on a journey of shopping discovery –on that will put governments on alert and cause upheaval for a multibillion dollar industry whose secret marketing weapon finally has been uncovered.

Chapter 2 –This must be the place

As you watched E.T. gather up those Reese’s Pieces one by one, did you crave that distinctive taste? As Tom Cruise slid on his Ray Bans in ‘Top Gun’ did you wish you too had a pair? When Simon Cowell took a sip of Cocaâ€Cola during an episode of ‘American Idol’, did you feel an inexplicable thirst? The Cocaâ€Cola Company, and the two other key sponsors of ‘American Idol’ hope so, since they each shell out over $26 million annually on their ‘American Idol’ campaigns. Marketers have believed in the efficacy of product placement for decades, Project Buyology monitored the brains of hundreds of ‘American Idol’ viewers to ascertain if this belief was wellâ€founded. We monitored reactions to Simon idly sipping a Coke, Paula Abdul casually mentioning Ford as she was raved about a hopeful performer, and Ryan Seacrest, reminding viewers to vote for their favourite contestant via AT&T Wireless textâ€messaging. Did consumers’ brains pick up on the brand placements, or were they lost among the 2,000 other brand messages we receive every day? In 2006, companies paid a total of $3.36 billion globally to have their products placed in TV shows, movies and music videos. Yet noâ€one has put the technique of product placement to the test. Not, that is, until September 2007, when Project Buyology scanned hundreds of consumer brains to test the effectiveness of product placement for the very first time.

Chapter 3 –I’ll have what she’s having

In 2004, Steve Jobs, the founder and CEO of Apple, was strolling along Madison Avenue in New York City when he noticed something strange, and gratifying. Hip white earphones snaking out of people’s ears, dangling across their chests, peeking out of pockets, purses and backpacks. They were everywhere. “Oh, my God, it’s starting to happen,†Jobs reported. But there was more to this story: a discovery made in the late 80s involving the macaque monkey would be instrumental in understanding why the iPod would become one of the world’s biggest brand successes. So, what does the behavior of a macaque monkey have to do with the astounding popularity of the iPod? A little function in our brain so significant that it is to psychology what DNA is to molecular biology, provides the explanation sheds light on a wide range of consumer behaviors. It explains why a simple smile from a salesperson can compel us to spend more money, why video games like ‘Guitar Hero’ are so popular, and why we’re hardwired to shop until we drop.

Chapter 4 –I can’t see clearly now

In 1957, when a market researcher named James Vicary claimed that a lightningâ€quick image of a Cocaâ€Cola bottle –flashed for less than 1/3000thof a second on a movie screen –was enough to make the audience rush to the concession stands, America was shocked. If marketers could use hidden messages to get us to buy, couldn’t other agencies use similar tactics to psychologically manipulate our behavior? The term ‘subliminal advertising’ was coined, and its practice just as quickly banned, in 1957. Since then, noâ€one has explored the potential influence of subliminal advertising. Fifty years later, scientists from across the world gathered in a lab in Oxford under Project Buyology. Lindstrom and some of the world’s most respected neuroscientists embarked on a mission to discover whether or not subliminal messages still surround us, and the extent to which they really influence our behavior. But be warned, what you’re about to see –or rather not see –may alarm you.

Chapter 5 –Do you believe in magic?

Let’s pretend we’re at a beachfront bar in Acapulco. Two iceâ€cold Coronas coming right up, complete with lime wedges. We give the limes a squeeze, and stick them inside the necks of our bottles, tip the bottles upside down until the bubbles begin to get that nice fizz, and take a sip. Cheers. But first, let me pester you with a multiple choice question. The Corona beerâ€andâ€lime ritual we just performed –any idea how that might have come about?

A) That’s the way Latin cultures quaff their Coronas.

B) The ritual derives from an ancient Mesoâ€American technique for combating germs, since the lime’s acidity destroys bacteria.

C) A bartender at an unnamed restaurant, on a random bet with his buddy, popped a lime wedge into the neck of a Corona to see if he could get other patrons to do the same.

When you’ve read this chapter you’ll see the Corona beer ritual in a whole new light. As you will the thousands of rituals that manufacturers build into brands to seduce you. Just like having a lucky pen you always take to important meetings, or the fear of the number 13, eating the filling of your Oreo cookie first –turns out, the relationship between such everyday rituals and why we buy is close and inescapable. And as you’ll read in Buyology, many of the rituals we habitually perform in our daily lives were actually orchestrated by companies and marketers to draw us to their brands and products.

Chapter 6 –I say a little prayer

What connection, if any, exists between religion and our buying behavior? Are there similarities between the way our brains respond to religious and spiritual symbols, and the way they react to products or brands? Could certain products inspire the same sense of devotion and loyalty in us, as those provoked by faith or religion? Might companies be borrowing from the world of religion, without our knowing it, when advertising their products? Project Buyology wasn’t downplaying the importance of religion in people’s lives when it found that these connections were more powerful than we ever realized. It is as controversial a proposition as can be imagined –the relationship between religion and branding. But what explains why Apple fans queue for days to get hold of an iPhone, why Harleyâ€Davidson riders are obsessed with their bikes, and why a girl’s love of Hello Kitty sent a family broke?

Chapter 7 –Why did I choose you?

Did you know that 60 percent of the products we buy in the supermarket we choose spontaneously, and that 80 percent of these we picked within just four seconds? We make hundreds of snap decisions each and every day. Yet so many of them happen deep within our subconscious, so fast and far instinctively we’re barely aware of them. In Buyology, you’ll read how companies plant instant shortcuts –or brand bookmarks –in our subconscious to help us decide what to (or what not to) buy. And yes, your brain too holds some of them and they’ve probably influenced everything from the make of the last car you decided to buy to the brand of coffee you brewed this morning. Some brands are discovering the key to controlling those four vital seconds that we spend at the supermarket shelf –learning how to encourage us within that tiny timeframe to pick their brand instead of another. The somatic marker phenomenon led Project Buyology into an experiment involving one of the bestâ€known –and apparently irritating –sounds in the world, revealing findings that left the marketing executives at Nokia flabbergasted.

Chapter 8 –This must be the place

Does your heart rate increase when you glimpse one of those signature robinâ€egg blue Tiffany boxes? Or maybe you feel your pulse race when you inhale the scent of a new car. A few years ago, Martin Lindstrom conducted a test. He presented 600 women with an empty Tiffany’s box each. Monitoring their heart rates and blood pressure, researchers found that, when the women received the box, their heart rates went up 20 percent. The women saw no logo, just the color. Its powerful associations with engagement, marriage, babies and fertility got those hearts racing. Similarly, Project Buyologyset out to discover why Playâ€Dohand Crayolaseem to spark a special recognition in us as we smell. And why there is much more to Johnson & Johnson’s baby powder than its wonderful smell. In a fascinating experiment, Lindstrom and his team of neuroscientists used fMRItechnology to examine the influence our senses have on what we buy.

Chapter 9 –And the answer is…

Remember when Coke altered its secret recipe to produce New Coke? Sales plummeted. Sure, the company had tested the new product before embarking on this multiâ€million dollar disaster. So how did the 200,000 people who participated in the extensive market research get it wrong? The fact is, nine out of ten product releases fail. So if market research is so unreliable, how can companies get the information they need to develop products that consumers really want? It’s time for a new approach. Via neuromarketing, Lindstrom and his team examined consumer brains to uncover the hidden motivations, needs and desires that our conscious minds aren’t aware of. Using the pilot of a TV game show as the test product, Lindstrom and the team discovered that what hundreds of test participants said they hated they really kind of loved.

Chapter 10 –Let’s spend the night together

Are you interested in sex? That got your attention, didn’t it? In this chapter, Lindstrom and his team of neuroscientists take a look at whether sex in advertising succeeds in seducing our interest in products, or whether it backfires. Sometimes it works, sometimes it doesn’t. From Calvin Klein to an Italian ad campaign that will make you shudder, Buyologyputs an ageâ€old question to the test: does sex sell?

Chapter 11 –Summary

Buyologybears witness to an historic meeting between science and marketing: a union of apparent opposites that sheds new light on why we make decisions about what we buy. Thanks to neuroimaging, we can now understand better what really drives our behavior, our opinions, our preference for Corona over Budweiser, iPods over Zunes, or MacDonald’s over Wendy’s. Through Project Buyology, neuromarketinghas emerged as a powerful new tool in understanding consumers’ decisionâ€making processes. This methodology is ready to revolutionize our understanding of our own buying behavior and send shock waves throughout the marketing and advertising industries as well as the business world. You’re about to discover your own ‘buyology’.

February 17th, 2009 — Entrepreneurship, Environment

The transport industry in general is a high user of fossil fuel and is causing the depletion of the world resource. The need to resort to renewable source is capital in the future. Sweden as a country has started using bio fuel for years and is quite advanced in use of ethanol. E10 and later E15 mixture with gasoline has become common. We expect a higher proportion of bio-fuel in the mixture in the future.

As an entrepreneur much can be learned from the swedish experience and possibly convert these knowledge in wealth.

I am surprised to learn today, that the first test of using a mixture of bio-fuel with Jet A1 extracted from fossil oil has been successful.

A Japanese airline has become the first Asian carrier to fly using bio-fuel. The Jumbo Jet took off on a 90-minute demonstration flight from Tokyo using a blend of 50 per cent standard aviation fuel mixed with oil derived from several forms of vegetation including algae. But analysts say that bio-fuel production must become cost-effective if it is to be a viable alternative to kerosene.

I invite you to watch the video produce on the subject.

February 16th, 2009 — Chinois

Hu jin tao is on a state visit. Why is Mauritius on the list of 5 nations , Saudi Arabia, Senegal, Mali, Tanzania? This is his second trip to Africa since the 2006 Beijing Summit of the Forum on China-Africa Cooperation.

The two day visit is going to disrupt our usual routine and mark the visit of one of the most influential person of the world. School children and civil servants will be on leave and the main roads closed to traffic. Is it too much fuss for the event?

We have been told that this is the security norm for a state visit. Mauritius does not want something dramatical to President Hu to happen during his visit and we want him to be impressed by Mauritius as a hospitable and friendly nation. Let us be realistic, who has more to gain out of this visit?

Being a China born person, I personally feel a sense of connection to China. I see the progress of China in world affairs as justified not because of my back ground but more importantly because China has the largest population of the world.

Let us enjoy his visit and hope that the ties between our two nations get even stronger.

February 15th, 2009 — La fete de 3, Messe

Mc 1,40-45.

Un lépreux vient trouver Jésus ; il tombe à ses genoux et le supplie : « Si

tu le veux, tu peux me purifier. »

Pris de pitié devant cet homme, Jésus étendit la main, le toucha et lui dit

: « Je le veux, sois purifié. »

A l’instant même, sa lèpre le quitta et il fut purifié.

Aussitôt Jésus le renvoya avec cet avertissement sévère :

« Attention, ne dis rien à personne, mais va te montrer au prêtre. Et

donne pour ta purification ce que Moïse prescrit dans la Loi : ta guérison

sera pour les gens un témoignage. »

Une fois parti, cet homme se mit à proclamer et à répandre la nouvelle, de

sorte qu’il n’était plus possible à Jésus d’entrer ouvertement dans une

ville. Il était obligé d’éviter les lieux habités, mais de partout on

venait à lui.

===================================================================

J’observe de plus près la demande du lépreux. Aurai-je formulé une demande de guérison dans ce sens à mon Dieu? Le lépreux demande t il une guérison, ou sollicite t il d’être purifier ? Bien sur j’aurai tombé à genoux pour supplier, étant dans la détresse. « Si tu le veux, tu peux me purifier », sous entend le respect de la volonté de Dieu et la foi dans sa capacité. Le lépreux dans sa supplication met toute sa confiance dans son Seigneur Maître qui saura faire ce qui est bon pour lui.

Je vois ainsi, dans la demande du lépreux, une foi en la capacité de Dieu non seulement de guérir et de lui rendre pur, mais également une convergence entre son désir et la volonté de Dieu.

Je te reconnais Père, pourvoyeur de tout, que ton nom soit sanctifier, que la volonté du Père soit faite avant tout. Est-ce cela sous entend également que si mon désir ne concorde pas avec ta volonté, j’accepterai également car Dieu d’amour sait mieux ce qui est bon pour moi ?

Être en accord avec la volonté de Dieu. Comment le savoir ? Il m’a dit qu’il sera avec moi jusqu’à la fin des temps ; j’y crois mais pas assez. Il est toujours la mais moi :pas toujours.

Je te demande ce matin, augmenter en moi, la conscience de ta présence et de ton amour. Que je me purifie de mes manquements afin je puisse être en permanence avec toi et être en communion avec toi. Si tu le veux, je souhaiterai que Tu vies en moi et que chacun de mes gestes et actions soient purs en conformité de ta volonté.

February 13th, 2009 — Reflexion

The petroleum industry has established record levels of profitability in 2008.

This is the case of Shell

Royal Dutch Shell’s fourth quarter 2008 earnings, on a current cost of supplies (CCS) basis, were $4.8 billion compared to $6.7 billion a year ago. Basic CCS earnings per share decreased by 27% versus the same quarter a year ago.

- Full year 2008 CCS earnings were $31.4 billion compared to $27.6 billion for the full year 2007. Basic CCS earnings per share for the full year 2008 increased by 16% when compared to 2007.

- Cash flow from operating activities for the fourth quarter 2008 was $10.3 billion. Net capital investment for the quarter was $6.8 billion. Total cash returned to shareholders, in the form of dividends and share repurchases, was $2.7 billion.

- A fourth quarter 2008 dividend has been announced of $0.40 per share, an increase of 11% over the US dollar dividend for the same period in 2007.

- The first quarter 2009 dividend is expected to be declared at $0.42 per share, an increase of 5% compared to the first quarter 2008 US dollar dividend.

Royal Dutch Shell Chief Executive Jeroen van der Veer commented: “We delivered satisfactory performance in the fourth quarter of 2008, given the pressure on demand for oil and gas due to a weaker global economy. Our strategy remains to pay competitive and progressive dividends, and to make significant investments in the company for future profitability. Industry conditions remain challenging, and we are continuing the focus on capital and cost discipline in Shell.”

Exxon Mobil will be announcing their 2008 performance early in March.

ExxonMobil’s 2009 Analyst Meeting will take place on Thursday, March 5, 2009, with a live audio webcast beginning at 9 a.m. EST, 8 a.m. CST. The webcast will last for approximately 3 hours. ExxonMobil’s presenters will be led by Chairman and CEO, Rex Tillerson.

BP released their last quarter and final 2008 results a week ago.

For the full year, replacement cost profit was $25,593 million compared with $18,370 million a year ago, up 39%.

Total in France like other oil companies has also had a bumper year 2008.

A 14 % increase in adjusted net operating income from business segments for the year 2008 compared to 2007 was annonced earlier in Feburary.

We all recall that in 2008, we experienced the rise of the barrel of crude rising to 138 dollars. For sure there were plenty of speculations; the spectre of 200 dollars per barrel of crude soon was waived.

In a higher price situation, I postulate that the oil companies make higher margin, thus higher profit; yet when the price of the crude oil lowers to more reasonable level, the price for the consumers are readjusted with a delayed lag time but not in the same proportion as the drop of the oil.

Is it a situation of high price oil companies make increased margins, lower price they still make increased margin? This reminded me of a similar situation in my working life, where the head office of the company was charging a management fees of 20 % based on turnover with a guaranteed minimum amount irrespective of turnover. Win situation we all win; lost situation you loose and they do not loose.

February 12th, 2009 — Uncategorized

A friend who like me, has retired from work, sent me this quote:

Owners of capital will stimulate working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks which will have to be nationalized and State will have to take the road which will eventually lead to communism.

Karl Marx, Das Kapital, 1867

Is that what happened in the United States of America recently?

The banks are near bankruptcy now and the governments have to bail them out to save a financial crash. The nationalization has not happened yet and is not likely to happen although the governments are dishing out cash with strings attached and need of reporting.

Today, I saw the public admission of guilt of the President of the City Bank group regarding the lavish expenses which the company were supporting whilst on the other hand begging the Government for help. He has since cancelled the order of the executive jet and the executives are now travelling with commercial aircraft.

I do hope that the incentive package of Obama gets through and more importantly the world economy would be back in better state.

February 11th, 2009 — Family stories, Mauritius

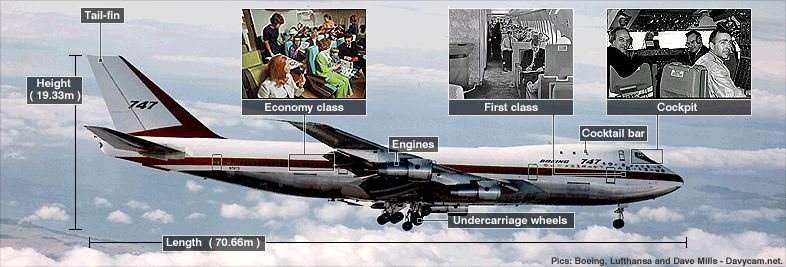

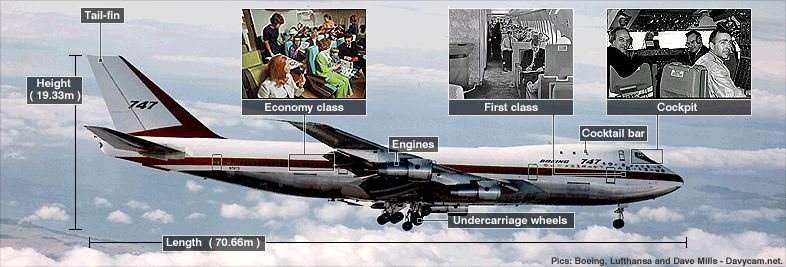

Four decades of a flying giant

The very first time I flew in a B747 was sometime in 1970. Air India for whom I was working for invited me to sample this enormous aircraft compared to the B707, that regularly serviced the Bombay –Mauritius run.

I flew from Bombay to Delhi on the inaugural flight.

The original Boeing 747 was so big that airports had to be adapted to accommodate it. Hangars were enlarged to fit the tail-fin, while tow-trucks and stairs on the taxiway had to be changed. The turbofan engines were more powerful and quieter than jet engines. There were 16 wheels – twice the normal – to spread the weight.

Passengers in economy class had a greater sense of space because there were twin aisles and higher storage cabins. Travellers in first class had access to a cocktail bar up a spiral staircase. Pilots (two plus a flight engineer) had to be retrained in new simulators because the cockpit was so high off the ground.

Four decades ago, Boeing’s prototype 747 took to the skies over Washington State for a flight lasting some 75 minutes.

The aircraft, named City of Everett after the location of the factory where it was manufactured, handled well. And so was born the aircraft which has become an icon of the aviation industry and helped bring cheap airline travel to millions of people.

What then made the 747 unique was that it was the first “wide body” aircraft – it had more than one aisle. Today this is the norm for most long haul (and some short haul) aircraft. But at the time it was a big step towards reducing any sense of travelling in a narrow tube, and inducing a sense more equivalent to flying in a large room with high ceilings.

Also new was the upper deck, accessed by a spiral staircase. When the aircraft entered service this was initially a rather exclusive bar for first class passengers – today it is more typically used as an additional business or economy class seating area.

Air Mauritius for a number of years flew the SP versions of the B747 which were on lease from South African Airways which had autonomy of 14 hours of flying. One of the key factors for the sucess of Mauritius as a preferred sunshine holiday for Europeans was the non stop service offered as early as the 70’s by Air Mauritius on a SP B747.

February 10th, 2009 — Uncategorized

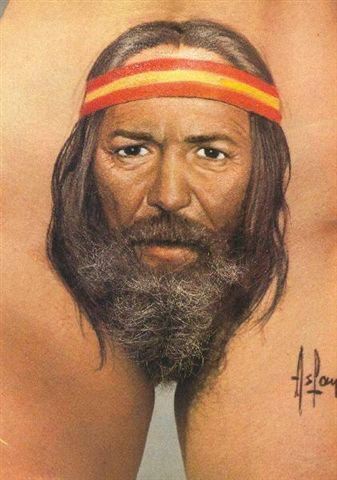

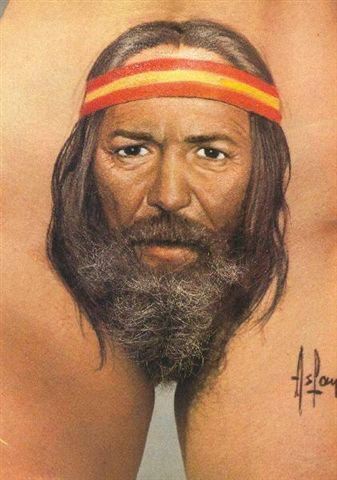

Could you guess on what material was the painting drawn?

You are right, it is a living material. I found the beard almost real?

This was one of the paintings presented at a paintings competition at Keys west in Florida USA.

xxx

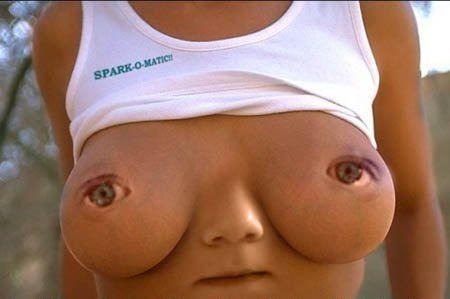

Watch out for the next one.

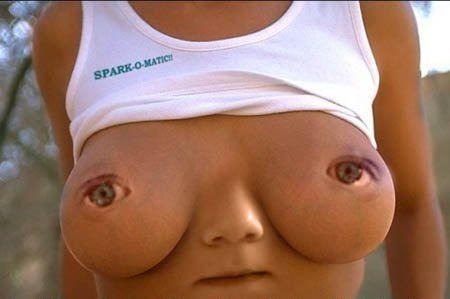

Do you like this babe?